It’s been one of the most dramatic changes in the concert landscape in the past 10 years: the spawning of hundreds of new music festivals worldwide. There are of course many reasons for this: the need for musicians to augment shrinking revenues from CD and streaming sales/royalties with live performance fees, the popularity of festivals as a way the fan can see 10–20 bands or more over 2–3 days, and the benefit to promoters from both the scale and quantity of performances. With– according to SXSW– more than 32 million people attending at least one music festival a year in the U.S., they have become “a mainstream pastime of our culture.” (And according to a 2015 Nielsen report, most fans travel 903 miles on average to be at a festival– an amazing stat.)

This phenomenon was the subject of a special panel session, The Future of Music Festivals, Friday March 17th, 2017 at the SXSW Music festival and conference in Austin. And it’s the subject of much future-planning for the industry at large.

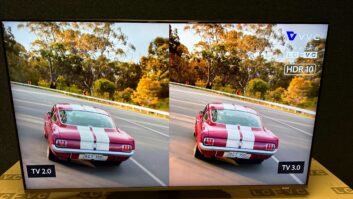

Behind the festivals trend as it played out in recent years in the U.S. is the phenomenon that music concerts at many festivals are no longer just “concerts.” They are shows with high production values, demanding big ticket prices. Concert ticket prices are up significantly and there are more outdoor events (because most music festivals are outdoor events). Many are major events with massive video technology that goes beyond IMAG to create elaborate visual experiences for all attendees, even in huge outdoor venues. Big production values are the norm. Stages now hold much more equipment, including massive LED screens (often 40 feet high or more), the latest line array loudspeaker rigs, and of course all the other audio, video, and rigging gear it takes to entertain increasingly jaded fans who now have literally hundreds of festival choices each season. Prime example: Milwuakee, WI’s Summerfest, billed as The World’s Largest Music Festival. Hitting its 50th anniversary this year, the event stretches over 11 days, serving up more than 800 acts on 12 stages as it provides more than 1,000 performances, with 900,000 people in attendance. The kinds of acts vary greatly across all genres, but also all levels of success; headliners last year at the Marcos Amphitheater included Paul McCartney, Sting & Peter Gabriel, Luke Bryan, Pitbull, Selena Gomez and Weezer, among others.

But with the explosion in the number and kind of festivals, we have many trends going at once. The big are getting bigger. But there are also other trends. For example: a new festival subtrend is emerging: The Micro Festival. A prime example is the new Starry Nites Festival which debuted March 18-19, 2017 on a 42-acre ranch in Santa Barbara, CA. Intended to attract 3,000- 5,000 attendees, the lineup included Alan Parsons, The Kills, Cat Power, The Dandy Warhols, She Wants Revenge, Black Mountain, Teenage Fanclub, Strawberry Alarm Clock, and 30 other artists. Starry Nites was co-sponsored by Roland, BOSS, and V-MODA, and presented by Desert Stars Festival, Starry Records, and Shiny Penny Productions.

As much as readers of this publication love big production values and the latest line array and high lumen IMAG technology at the big festivals, what is the future of music festivals? Will the rise of niche festivals take away from the bigger festivals? Not likely. Big production value festivals will continue, but it behooves anyone involved in outdoor concerts and festivals in particular to listen to what’s discussed at SXSW– the conference track is known for shining a light on strong new trends the rest of the country doesn’t immediately see.

SXSW music festival is a long-established indoor (mainly) event. Like many festivals, they’ve promoted and encouraged new acts. Big names to participate in the event over the years include Snoop Dogg, Lady Gaga, Kendrick Lamar, Bruce Springsteen, Quincy Jones, Pete Townshend, Lou Reed, Smokey Robinson, Johnny Cash, Elvis Costello, David Byrne, Daryl Hall, Mick Jones, Tony James, Neil Young, Seymour Stein, Shawn Fanning, Courtney Love, Sean Parker, Chrissie Hynde, and many more top acts from all corners of the music business.

But as befits SXSW also, they often prompt professional conference attendees to think outside the box. The starting premise for the discussion at the Future of Music Festivals panel at Sx (“southby”) was that despite the advancements in technology, sound engineering, and digital media, large festivals are perceived by some fans and artists as having “become generic, boasting similar lineups and experiences.”

“So how can we reshape the future of music festivals?” was the question the session explored. The panel assembled some top festival players helping to redefine the music festival experience–cultivating and supporting local music scenes, sourcing unique performances, and creating new economic opportunities for musicians, while fostering new visions for what a music festival can be for fans and artists. With moderator Doug Freeman of The Austin Chronicle, the panel consisted of Jeff Vetting of Vulcan Inc, who is launching the new Upstream festival in Seattle; Robin McNicol, one of the managers of the huge Bonnaroo festival; and Christian Morin, a top festival promoter in Germany.

All of the panelists coalesced around one theme: big festival lineups are more similar than they used to be– one reason being that a few big festival promotion companies are buying up others. But even as the festival models morph, there is through it all, for the past 5-10 years, the constant that festivals have been “propping up” the music economy. In other words: yes, the decline of revenue for artists and promoters from recorded or streamed music has everyone on the road and the festival is the most dateand artist-packed platform there is. The panel delved into ways that festival business models are evolving to meet new challenges on both the provider and artist side.

Jeff Vetting–whose new Upstream festival in Seattle (first one May 2017) is an “indoor” festival i.e. with performances scattered around clubs and other indoor venues (similar to SXSW in Austin)– sees a new role for festivals helping artists “make money after they play, to continue to make money… we want to help the emerging artists, not just have them play our stages.”

Christian Morin echoed all the panelists in reminding that “you can’t finance the festival from just the ticket sales, so, you need either public money, or corporate sponsors.” That public money he referred to is an EU, or German, phenomenon. Freeman joked that “we don’t know anything about corporate sponsorship…” referring of course to the fact that at SXSW in Austin corporate sponsorship money is everywhere.

“People tolerate the corporate sponsorship much more now,” said Robin McNicol. And Vetting said that the goal now is to “turn that into a positive experience–the model does not work without it.”

On the technology front, don’t think this was a back-to-basics only discussion. Live video streaming from the festival is one tool that all the panelists– at least all the American ones– said was an increasing trend for festivals. And all agreed that live video streaming does not cannibalize live attendance.

“Video streaming is a sponsorship thing,” said McNicol, “and it does not stop people from buying tickets.” Vetting said that he is now putting together streaming deals for the Upstream festival. In addition to more live streaming of festivals, other tech tools that came under discussion were wayfinding (digital signage) for fans on site, RFID ticketing (to combat counterfeiting), and an increase in apps that tell fans on site who’s playing where and when and can even be set up for digital “tip jars” for the artists.