Duchossois Industries Acquires AMX for $22.50 Per Share

Feb 15, 2005 11:57 AM

AMX and Duchossois Industries have announced that they have entered into a definitive agreement in which an affiliate of Duchossois will acquire AMX. Under the terms of the agreement, AMX shareholders will receive $22.50 per share in cash, a 28 percent premium over the average closing price of AMX’s common stock for the 90 trading days ended Feb. 14, 2005. The total transaction is valued at approximately $315 million. The Duchossois affiliate is expected to commence a tender offer for all of AMX’s outstanding common stock within the next five business days which will, subject to extension in certain cases, remain open for 20 business days following the commencement of the offer.

“The AMX Board of Directors and management team have determined that the Duchossois offer is the best approach to maximize shareholder value,” said Bob Carroll, AMX president and CEO. “The agreement signed with Duchossois provides shareholders an excellent return on their AMX stock investment. Just two years ago, AMX had a market capitalization of approximately $12 million and is today valued at approximately $315 million through the Duchossois offer. This clearly is a win for our shareholders.”

The AMX board of directors has unanimously approved the transaction. Consummation of the tender offer is conditioned upon matters customary in similar transactions. The parties expect Duchossois’ acquisition of AMX to be completed during the second calendar quarter of 2005. Following the Duchossois affiliate’s acquisition of at least a majority of AMX’s fully diluted outstanding shares in the tender offer, the Duchossois affiliate will merge with and into AMX, with any shares not tendered in the tender offer being converted into the right to receive $22.50 per share in cash, and employee stock options being exchanged for $22.50 per share in cash less the exercise price of such options. AMX will continue to be headquartered in Richardson, Texas, and will maintain the AMX name and brand. The AMX management team, along with its employees, will remain in place following the acquisition, and business operations will continue as usual.

Shareholders, including AMX’s directors and officers, holding a total of approximately 17.7 percent of the outstanding shares of AMX, have entered into separate agreements in which they have agreed, subject to certain conditions, to tender their shares in support of the transaction.

Carroll added, “AMX is pleased to join Duchossois Industries because of its proven history of building successful businesses. We will continue to build upon the solid platform we have established to grow AMX’s existing business. An alliance with Duchossois will help accelerate new research and development and acquisition programs that will enhance our growing product portfolio. Our proven successes, coupled with Duchossois’ operating experience, relationships, and financial resources, will strengthen our industry leadership position and assure our future growth.”

“We have a deep appreciation for the hundreds of individuals who have built the impressive AMX organization over the past two decades,” said Craig Duchossois CEO of Duchossois Industries. “The strength of AMX’s management team and employees has created an industry leader and top innovator of control system technology.” Duchossois added, “Our goal is to significantly enhance AMX’s leadership position through expanded research and development and acquisition programs, enabling the company to grow into new markets. We look forward to working with Bob Carroll and the rest of the AMX team to build upon the strengths of this world-class company and deliver even greater value to its customers and partners.”

Duchossois acquires and invests in companies with exceptional management teams and compelling technology. Duchossois’ holdings include The Chamberlain Group, a maker of consumer and commercial garage door openers and other access control products, and Duchossois Technology Partners, which invests in advanced-technology ventures.

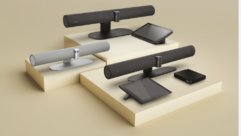

AMX products enable residential and commercial customers to centrally manage and control a variety of audio/video, environmental, and communications technologies. Customers also leverage the company’s advanced hardware and software platforms to store and distribute digital content, as well as to manage a selection of resources and services.

AMX customers will continue to place product orders and request technical support through the same procedures. Customers’ direct sales, distributor and independent representation contacts will not change, and AMX’s current relationship with its manufacturing and operations partners and suppliers will not be affected.

Seven Hills Partners LLC acted as the financial adviser to AMX Corporation in this transaction.