Will Consumer TV Price and Quality Battles Impact the Corporate Market?

Sep 22, 2005 2:45 PM

Committing to a video display technology for a corporate setting never seems to get any easier. A spate of recent reports suggests that the choices are about to get, if anything, more complicated.

Among the biggest recent news is InFocus’ announcement that it is shuffling some management out the door, planning to drastically cut staff, and giving up on its ultra-thin display business, both direct-view and rear projection. InFocus was early in the DLP rear-projection TV market, but the company’s announcement blames intense price competition for making this market position untenable.

DLPs had drawn a lot of favorable attention for both quality and attractive price points, and the same downward price pressure that drove InFocus out of the arena seems to be powering a new growth in sales. Quixel Research reported in mid-August that after two straight quarters of declining volume and value shares, DLP TV sales were up 10 and 11 percent in these areas, and revenues topped $404 million in the second quarter of 2005. Revenues in the United States were up 74 percent year-to-year, Quixel says, terming the second quarter results a photo finish between DLP- and LCD-based products.

Both product types, of course, are also taking aim at the plasma industry. Pacific Media Associates reports LCDs have overtaken plasmas in their share of the 37in. TV market. Other size ranges are also in the crosshairs. “Once the giant LCD fabrication facilities in Asia reach full capacity and can produce 42in. glass panels considerably more cheaply and in much greater quantity than today, we expect a huge battle between LCD and plasma,” PMA comments.

Where does this leave corporate buyers and their integrators? Do they buy on price, a factor that changes all the time and becomes more favorable in the process? Or do they compare quality, reliability, and other factors?

“What does corporate want?” asks Chris Chinnock of Insight Media, noting that the recent CEDIA

Expo abounded in large-screen video displays that could fit well into corporate settings. “I don’t know,” he answers. “In fact, this whole segment of rear-projection monitor/TVs for the pro AV market is a kind of black hole. There are not a lot of sales there and no one knows the size, the issues, or the opportunities.”

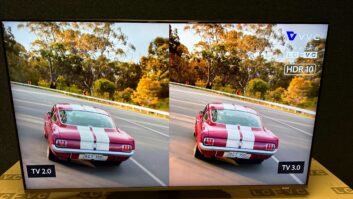

Another complication: The state of the art in image quality keeps moving. Chinnock says Insight Media editors reviewed five new LCOS rear projection TV systems in a carefully controlled test this summer, using test patterns from DisplayMate as well as other content. (DisplayMate has supplied similar content for the a href=”http://www.infocomm.com” target=”_blank”>InfoComm Projection Shoot-Out over the years.)

DisplayMate President Ray Soneira will report his findings in the November issue of Widescreen Review. In the meantime, though, he offers a bottom line assessment: LCOS-RPTVs are the new image-quality benchmark standard.

Prices, though, remain well above the level where LCDs, DLPs, and plasmas are slugging it out.

All of these developments may leave the corporate buyer in a bit of a spin—and keep the Pro AV channel wondering if corporate video users actually want something different in their board room from what they have in their den.