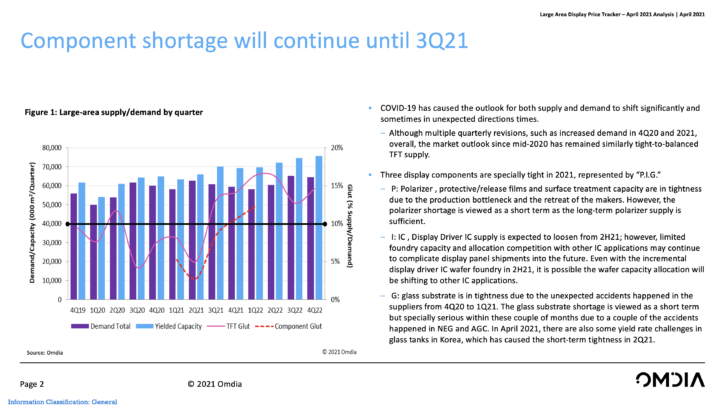

Based on Omdia’s Large Area Display Price Tracker, April 2021, Sanju Khatri, director of consulting for displays, ProAV and consumer devices at research and consultancy firm Omdia, provided some analysis on disruption in the display supply chain due to component shortage and high demand. Impact will be mostly felt on LCD technology, as strong demand and component shortage will lead to the following price cycles for LCD panels.

To read more about the broader supply situation, here’s our interview with manufacturers including Crestron, Valens, Barco, Legrand AV, MXL, and AVIXA .

EDITOR’S NOTE: Three distinct terms are used below. Components (display driver IC, glass, and polarizer); panel (raw LCD panels) and brands/finished sets/device vendors (TV, monitor/laptops/ProAV vendors).

- Component price increase (1Q21-2Q21)

- Strong consumer demand for TVs/IT displays. The “at home” trends are including work at home, learn at home, entertain at home and shop at home. The LCD TV, Notebook, LCD monitor, and tablet PC products continue to have the strong demand thanks to the “at home” trends.

- Brands, set makers, OEM, ODM, and retailers are all intending to fill up the pipeline in order to sell more.

- TV brands and OEMs are continuously purchasing more panels (some are double-booking) to hit business targets.

- Display panel makers are increasing prices sharply to take the fast turnaround on profitability. The LCD TV open cell prices have been increasing by 40%-50% from June 2020 to December 2020. And it is expected there will be another 20% increase from January 2021 to May 2021.

- Component shortage(Glass substrate, Display Driver IC, T-con, PMIC, Polarizer films) are frustrating the supply chain from time to time, making the set makers to be more nervous thus giving more orders. Three display components are especially tight in 2021, represented by “P.I.G.”

- P: Polarizer, protective/release films and surface treatment capacity are in tightness due to the production bottleneck and the retreat of the makers. However, the polarizer shortage is viewed as a short term as the long-term polarizer supply is sufficient.

- I: IC, Display Driver IC supply is expected to loosen from 2H21however, limited foundry capacity and allocation competition with other IC applications may continue to complicate display panel shipments into the future. Even with the incremental display driver IC wafer foundry in the second half of 2021 (2H21), it is possible the wafer capacity allocation will be shifting to other IC applications.

- G: Glass substrate is in tightness due to the unexpected accidents happened in the suppliers from 4Q20 to 1Q21. The glass substrate shortage is viewed as a short term but especially serious within these couple of months due to some accidents that happened in NEG and AGC. The recovery schedule is expected to take 6 months in Omdia’s estimation. In April 2021, there were also some yield rate challenges in glass tanks in Korea, which caused the short-term tightness in 2Q21.

- 3Q and 4Q 2021 (stabilization of display panel price)

- We expect panel prices to gradually flatten in 3Q21 as the “at home” boom cools down and the labor force return to work.

- New display panel capacity in China gradually ramps up, and the incremental capacities from the expanded phases of the existing fabs.

- The component shortage issues are gradually solved. New component capacities (glass tanks, wafer foundry) ramp up.

- By the end of 4Q21, with the increased capacity and mitigation of the component shortage issues and display panel prices will gradually go down.

READ MORE: Crestron, Barco, Valens, Legrand AV, MXL, and AVIXA talk about the issues.