UPDATE 4/27/20: The saga continues.

When we last left my Residential Systems colleague Henry Clifford he had failed to secure a small business loan through the Paycheck Protection Program (PPP) Not for lack of trying.

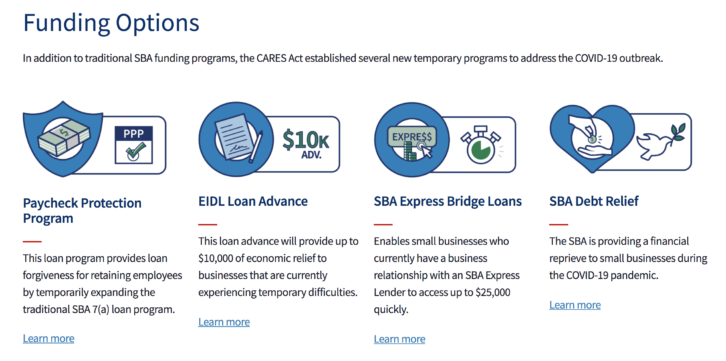

As a reminder, this program allows businesses to apply through Small Business Administration (SBA)-authorized lenders for 2.5x their average monthly payroll. If they use at least 75 percent of the funds for payroll between now and 30 June, the loan is forgiven..

Clifford began contacting his Bank of America banker the day after the CARES act passed in March and started the long process as journaled Friday April 3rd -10th.

It’s not over–let’s pick up the thread.

Saturday, April 11, 200: I saw a missed call from an unknown number and quickly returned it. “Hello, sir, this is Angela from Bank of America,” a voice greeted me. Waves of relief and excitement washed over me. Was this it? Would Angela have good news? “I was just calling to make sure you’ve uploaded all your documents to Intralinks,” she said. My hope immediately turned to rage as I quickly deduced Angela was calling as a courtesy and didn’t have any insight into where my application stood or whether or not my documents were correct. She was very nice, but I couldn’t have been more annoyed. How could the bank sit on my application for two weeks with no communication and then the only person to connect with me had no idea about my application? I pumped Angela for information and got nothing. I hung up more frustrated and angrier than before the call.

Wednesday, April 15, 2020: My CEO buddies start reporting great success applying with local banks, touting quick turnaround times and short approval windows. I’d been one of the first to apply with Bank of America and here I was watching my friends get their loans when they’d applied after me. I decided to hold on, surely Bank of America would come through. I’d been told numerous times by my relationship manager they’re the largest SBA lender in the country. Nevertheless, my anxiety levels started edging further north.

Thursday, April 16, 2020: SBA announces late in the morning that the PPP program is out of money. My stomach drops. I cling to hope that the bank had submitted my application to SBA and just hadn’t told me about it. Bank of America wouldn’t sit on my application for over two weeks and run the clock down, would they? That would amount to malpractice of the worst sort. I couldn’t fathom that reality. I started texting and emailing my personal banker to see if there was anything new to glean. In a late-evening phone call he said maybe it might be a good idea to apply to a local bank instead. My stomach dropped even lower. Every single one of my worst fears were confirmed in that phone call. The clock had run down, I’d done nothing to pivot and there I was holding the bag. MORE@Residential Systems